100 Businesses of the Inland Empire

I. Executive Summary

To ensure that the Inland Empire economy remains on the road to recovery we must provide our local small businesses with the resources they need to continue growing, innovating, and creating jobs. Congressman Takano visited 100 businesses in California’s 41st Congressional District to get a first-hand understanding of the challenges local business leaders face, and how to best advocate for the priorities of the Inland Empire while in Washington, DC. This report uses the knowledge gained through these visits and an accompanying survey to offer a set of policy proposals that will help get the Inland Empire back to work.

The Congressman visited book stores, coffee shops, manufacturers, software companies, retailers, and a number of other types of businesses across the Inland Empire. Although the businesses varied in size, location, and business sector, some of the most common concerns that business owners expressed included an inability to find qualified workers, difficulty affording employee benefits and pay, high utility costs, and inadequate access to capital. Despite these concerns, more than three-quarters of the businesses that completed the survey plan to hire additional employees in the near future, indicating that business owners are beginning to feel more confident about the improving economy.

Key Findings

- 77 percent of business respondents said they planned to hire additional employees, 47 percent of businesses planned to hire employees within the next six months.

- 31 percent of businesses surveyed said it was difficult to obtain a small business loan.

- 33 percent of respondents had vacancies that they were unable to fill. Businesses most often cited a lack of qualified applicants as the reason jobs were going unfilled.

- 67 percent of respondents said tax incentives would encourage them to hire veterans.

We can help small businesses in the Inland Empire by working to improve the quality of the local workforce, leveraging federal investment, raising awareness of federal programs for small businesses, improving access to capital, and strengthening resources that help businesses compete globally.

II. Business Visits and Survey Methodology

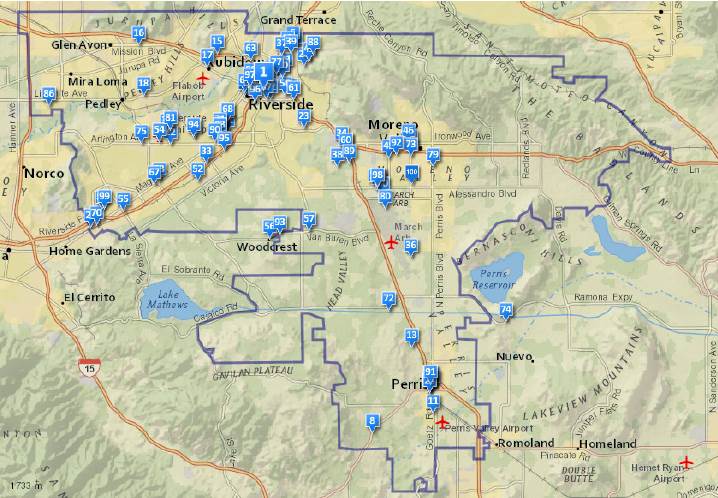

Congressman Takano visited one hundred businesses across the 41st Congressional District to gain an understanding of the business climate in our region, and to hear first-hand from business owners about not only the challenges they face, but the things that make the Inland Empire the right fit for their business. During each visit, the Congressman heard directly from business owners about issues unique to their company and was able to learn about ways the federal government can help these entrepreneurs succeed. The visits occurred over the course of several months, from August 2013 through March 2014. The original intent was complete all 100 visits in 100 days, but unforeseen changes to the Congressional legislative calendar required Congressman Takano to remain in Washington during days he planned for the visits.

After the visit, each business was asked to fill out a brief survey that included questions about the business’ demographics, access to capital, concerns with the labor force, and interaction with the federal government. The full list of questions and data tables are included in the appendix of this report. All business owners were presented with a survey, and responses were collected from 77 businesses. Not all questions were applicable to every business and some chose not to answer certain questions at their discretion. The survey was not scientific, however the responses helped create a snapshot of the Inland Empire’s recovering economy and ways the federal government can help small business owners excel.

Business Characteristics

The 100 businesses were located across the district and comprised a broad spectrum business models.

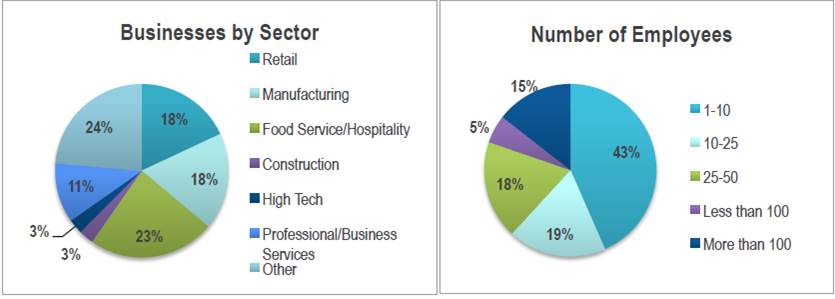

Business Sector and Number of Employees

Based on survey responses, nearly a quarter (17) of the businesses Congressman Takano visited were in the Food Service/Hospitality Industry. Retail (13) and manufacturing (13) also represented a significant number of businesses. However, many businesses didn’t fit into a clear cut category. “Other” responses included Environmental Engineering, Civil Engineering, Land Development, Commercial Printer, Wholesale Distributor, High Tech Agricultural Production, Emergency Vehicle Servicing, and Biotechnology. 43 percent (33) of respondents had fewer than ten employees. Of the businesses that responded, 71 percent (47) had fewer than 25 employees, and 80 percent (61) of the businesses had fewer than 50 employees.

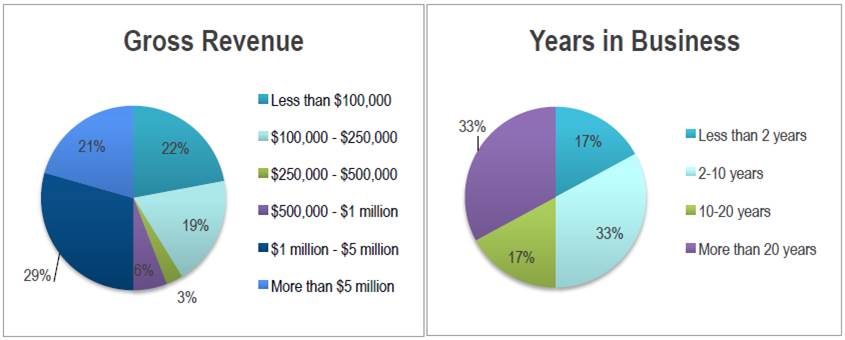

Revenue and Years in Business

The gross revenue also varied significantly among the businesses. According to survey responses, 22 percent (15) of business respondents earned less than $100,000 and another 21 percent (14) made more than $5 million annually. Half of the businesses (34) that responded earned less than $1 million in gross revenue a year. The businesses varied in terms of how long they had been operating in the Inland Empire. One third (25) of businesses that responded were well-established and had been in businesses for more than twenty years. However, one in six (13) business respondents had been in business for less than two years.

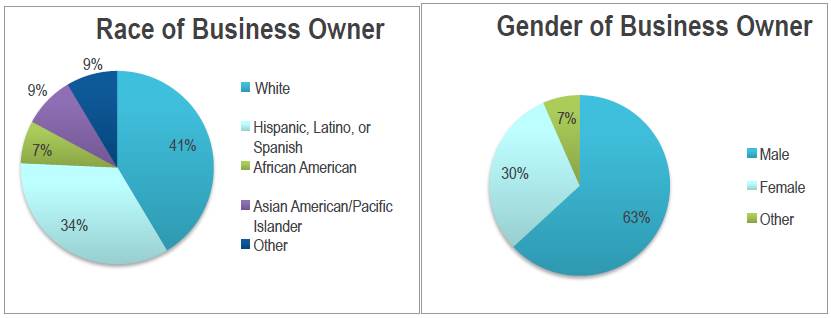

Minority and Women Owned Businesses

Congressman Takano visited businesses owned by a diverse range of Inland Empire residents. According to survey responses, 59 percent (41) of businesses visited were minority-owned. Roughly one third (24) of business owners who responded were Hispanic, Latino, or Spanish, 7 percent (5) were African American, 9 percent (6) were Asian American or Pacific Islander, another 9 percent (6) identified as other nationalities. While the majority of business owners were male, nearly a third (23) of the businesses Congressman Takano visited were owned by women.

III. Survey Findings

Access to Capital and Resources

One common concern from business owners across the country has been a lack of access to capital to help their business grow and adapt to changing market conditions. According to survey respondents, very few had tried to take out a small business loan in the last year. For those businesses that applied for loans, but were denied, insufficient collateral or a poor credit score were the greatest impediments. When asked, 31 percent (10) of the businesses that responded said it was difficult to obtain a loan, while 69 percent (22) said it was not. Twenty-one businesses that said they had difficulty accessing capital were unable to grow their business or hire new employees as a result, and 10 businesses were forced to close stores or branches.

Businesses were also asked about their familiarity with the Small Business Administration and the Inland Empire Small Business Development Center, both of which offer a wide array of resources to small businesses. Only 30 percent (21) of businesses that responded said they had worked with the SBA, and one in eight (9) said they had worked with the Inland Empire Small Business Development Center. Seven businesses who worked with the SBA participated in their loan guarantee program, while assistance from the IE SBDC was split evenly between start-up assistance, business plan assistance, marketing, and access to capital. Thirteen of the 21 businesses that worked with the SBA were pleased with the services and responsiveness of the agency, but common complaints included strict program requirements and a lack of mentoring programs.

Labor Force

Hiring Plans

The next portion of the survey asked business owners about their plans for hiring additional employees and the circumstances that impact their hiring decisions. Of the businesses that responded, more than three quarters (57) expressed plans to hire additional employees. Of those, forty-seven businesses responded that they expected to hire those employees within six months.

However, 17 businesses stated that they did not have plans to hire any additional employees in the next year. The top three reasons for not hiring additional employees were economic uncertainty, high taxes, and lack of available capital, in that order. Some business owners also raised concerns about the uncertainty of the Affordable Care Act on employer health costs.

Job Vacancies

Despite concerns about economic uncertainty and access to capital, 30 percent of the small business respondents found themselves with vacancies that they were unable to fill. By far the largest reason businesses were unable to fill vacancies was a lack of qualified applicants, according to seventy-one percent of those with vacancies. For a third of businesses, it takes less than two weeks to fill a vacancy, while it takes less than a month for another third of the businesses surveyed. For a small number of businesses it can take more than six months to fill vacancies. When asked what kind of skills applicants are lacking the responses were diverse and often very specific to the specific business. In general, businesses found that customer service was the most commonly lacking skill, followed by basic job skills, computer skills, and then mathematics.

Employer Sponsored Health Coverage

Veteran Employees

Riverside County has the eighth largest veteran population in the nation. One way to stimulate job growth and lower the unemployment rate is to help service members transition to the civilian workforce. Of the businesses that responded, 45 percent said that they had hired veterans and 67 percent said that tax incentives would make them more likely to hire veterans. However, a significant number of business owners also said that tax incentives wouldn’t make a difference if the veterans don’t possess the necessary job skills.

Operating a Business in Riverside County

Challenges

Business owners were asked to weigh in on some of the common challenges about operating a business in Riverside County. The cost of employee benefits was the most common concern, followed by worker compensation, taxes, utility costs, and availability of capital or credit. The most common write in concern had to do with uncertainty over the impact of the Affordable Care Act on small businesses.

Benefits

Business owners were also asked about what drew them to the Inland Empire and the benefits of operating a business in Riverside County. Location was the largest benefit for most business owners, followed by proximity to friends, family, and customers, and the cost of land and facilities compared to neighboring areas.

IV. Conclusion

After meeting with 100 businesses of various sizes and in different business sectors, clear trends began to emerge about how to improve the outlook for small businesses and create jobs in the Inland Empire. We need to increase efforts to improve our workforce, leverage federal resources, support local innovation, assist businesses with the implementation of the Affordable Care Act, help businesses compete in the global marketplace, and invest in rebuilding our infrastructure. As a high school teacher and Trustee on the Riverside Community College Board, Congressman Takano has seen first-hand the need for improvements to our nation’s education system. Additionally, as a member of the House Committee on Education and the Workforce’s Subcommittee on Higher Education and Workforce Training, Congressman Takano is a passionate advocate for reforms that will prepare students for jobs in the 21st Century workforce.

IMPROVE THE WORKFORCE

We must strive to ensure that we are preparing all Americans to succeed and excel in today’s global economy. That means improving education and training opportunities so that everyone can develop the skills needed to earn a living wage. Improving our workforce will also help small businesses in the Inland Empire to continue to grow and thrive. Roughly a quarter of respondents said it took more than six months to fill a job vacancy, and the most commonly cited reason was a lack of qualified applicants. Our region is lucky to have high quality educational institutions, but more needs to be done to help students transition to the workforce whether through traditional or alternative career pathways. Atlas D. Consolidated and Facility Shield International both mentioned a specific drop off in applicants with trade skills and certification. It’s clear that improving the Inland Empire workforce will require continued investments in higher education as well as job-training programs.

Strengthening Workforce Training Programs

The Workforce Investment Act (WIA) is the federal government’s main tool to develop and train a workforce ready to compete in today’s labor market. This landmark legislation had not been updated since 1998, and authorization for WIA programs expired in 2003. WIA funds help programs like the Riverside County Workforce Investment Board’s One Stop Center, which offers job training, placement, and business services for people of all ages. Whether assisting a young adult looking for their first job, someone trying to re-enter the job market, or a small business searching for qualified candidates, the Riverside County WIB connects workers and businesses in meaningful ways.

As a Member of the House Committee on Education and the Workforce, reauthorization of WIA was a top priority for Congressman Takano. That’s why he voted for H.R. 803, the Workforce Innovation and Opportunity Act. This bill reauthorizes and updates our federal workforce development laws and requires states to develop a strategic plan for workforce training programs, improve accountability to ensure programs are aligned to meet the needs of local communities and job-seekers, and increase funding for workforce training by seventeen percent over the next five years. The bill passed Congress and was signed into law by President Barack Obama on July 22, 2014.

Improving Primary Education

Reforms in K-12 education will help students down the line as they prepare for higher education and to enter the workforce. Congress should repeal and replace the flawed “No Child Left Behind” law that prescribes “one-size-fits-all” requirements on schools, teachers, and students. Instead, we need a system that includes an emphasis on science, technology, engineering, arts, and mathematics (STEAM) education, partnerships with community colleges and industry, and engaging teaching methods, will prepare Americans to compete in the global economy. Ensuring students have a strong basis in STEAM fields will guarantee that they are ready to fill the jobs at cutting edge businesses like IscaTech, Olfactor Laboratories, or Luminex Software.

Congress should also support alternative education models such as concurrent enrollment or early college models, like the Rubidoux Early College High School, a partnership with Riverside Community College which allows students to work towards their high school diploma while also earning college credits that can be applied to Career and Technical Education certification, an Associate's degree, or transferable credit toward a Bachelor's degree. These kinds of reforms will improve college readiness and prepare students for the workforce.

Making Higher Education More Affordable

Access to quality higher education is a hallmark of American society. Unfortunately, the rising cost of college has become a serious impediment for many students. While addressing the underlying causes of the rising cost, we should continue to support Pell Grants and fight to keep the interest rates on federal student loans low. Additionally, we should pass legislation like the Bank on Students Emergency Refinancing Act, which would allow student loan borrowers with public or private loans who borrowed before 2013 to refinance their loans to the lower market-based rates established for students last year. Loans borrowed for undergraduate education would be refinanced to 3.86 percent; loans borrowed for graduate education would be refinanced to 5.41 percent; and loans borrowed by parents for their child’s education would be refinanced to 6.41 percent. Congressman Takano is a cosponsor of Bank on Students Emergency Refinancing Act, as improving college affordability will help to ensure students aren’t saddled with insurmountable debt even before they enter the workforce.

Shutting Down Inefficient & Predatory For-Profit Colleges

Students who attend for-profit career training and certificate programs seem to be having the hardest time managing the student loan debt they accrue. They make up only thirteen percent of the higher education population, but are responsible for nearly half of all student loan defaults. Many of these students are graduating with mounting debt, but without the skills they need to start a career.

Federal law requires these institutions to prepare students for gainful employment in an occupation once they have completed the program. However, the federal government has never clearly defined or enforced this requirement. Too often this has allowed for-profit colleges to get away with using predatory and deceptive tactics to bully our most vulnerable students – including minority, veteran, and low-income students – into “career” programs that fail to make them career-ready.

Congressman Takano has led three letters to the Department of Education supporting their rulemaking process to define “gainful employment” and ensure that all students graduate with the skills they need for a career in their chose profession. This fall, Congressman Takano will be introducing the Protections and Regulations for Our (PRO) Students Act to protect students from bad actors in the for-profit college sector. The bill will guarantee that students have access to important and accurate information and data, strengthen oversight and regulation of the for-profit sector, and hold schools accountable for violations and poor performance. With these reforms we can help ensure that our student and taxpayer dollars are being well spent, and that students are receiving quality, affordable education

Reforming Our Immigration System

With more than 12 million immigrants living in the United States without legal status, millions of close family members waiting abroad to join their loved ones, and the continued detention and deportation of members of our community, it is clear that our immigration system is broken. Comprehensive Immigration Reform, including a path to citizenship, would provide a tremendous boost to our local and national economy. Finding a solution to our broken immigration system could add $1.5 trillion to the national economy over the next ten years and increase tax revenue by more than $5 billion in the first three years. The Senate Immigration Reform bill that passed last summer, would improve the employment based green card system by exempting immigrants with advanced degrees STEM fields from the green card caps.

Additionally, our current system fails to provide a steady, predictable labor force for our nation’s farmers and growers. It’s estimated that half of the agricultural workers in the country are undocumented, making it challenging for farmers to plan ahead and ensure that their crops get picked and ready for consumers. While visiting the Blue Banner Company, Congressman Takano heard about how immigration reform would help guarantee a more predictable workforce to ensure that California remains a leader in growing the world’s finest produce. The Senate Immigration Reform bill creates two new temporary worker programs for agricultural workers with offers of employment in the United States. These visas could be renewed and eventually immigrants could apply for permanent status and citizenship if they continue to work in agriculture. Not only is there a moral imperative to fixing our immigration system, it will boost the economy and allow the federal government to invest the increased revenue in further job creation initiatives. Congressman Takano has cosponsored the House companion to the Senate Immigration Reform bill and called on Speaker Boehner to take immediate action on this important legislation.

Improving Visa Programs

Comprehensive Immigration Reform must include improvements to our visa system that help bring both low and high skilled workers to our country. One successful program, known as the Immigrant Investor Program, or EB-5, gives visas to foreign investors who invested a minimum of one million dollars on a business venture in areas of high unemployment that will create or preserve at least ten full-time jobs for American workers. This program has particularly benefited Riverside County. SolarMax, which Congressman Takano visited, is an EB-5 business that has brought jobs to the IE and made crucial investments in renewable energy. In fact, twenty percent of the nation’s EB-5 regional centers are located in the County, and each of the twenty-eight cities has felt the positive impact of this program through increased jobs and business activity.

That does not mean the program is perfect. While touring businesses and getting feedback from constituents, Congressman Takano learned about the difficulty local EB-5 Centers were having with the U.S. Customs and Immigration Services (USCIS). As a result, Congressman Takano led letters with fellow members of the Inland Empire delegation to the USCIS Director Alejandro Mayorkas and the EB-5 Program Chief Nicholas Colucci asking for an explanation of the long wait times faced by local EB-5 centers. After meeting in person with Director Colucci, it was clear that the USCIS heard the concerns of the Inland Empire and was working to improve management of the EB-5 program.

LEVERAGE FEDERAL RESOURCES

There are many federal incentives and programs to help small business, but few businesses surveyed were aware of the different federal resources available to them. Greater outreach and focus by the federal government can ensure these resources are maximized.

Improve Awareness of the Small Business Administration and Bring Resources to the Inland Empire

The Small Business Administration (SBA) offers a wide variety of tools to help small businesses grow and compete. Whether it is a loan guarantee program to help small businesses get access to capital or contracting assistance to help small companies compete with larger firms for lucrative federal contracts, there are many resources available. The SBA also offers direct loan programs to businesses and management and technical assistance training programs to help businesses expand. Through his Small Business Advisory Group, and by conducting small business workshops, Congressman Takano will continue to share information about the resources the SBA can provide.

Being located so close to the Los Angeles Metropolitan Area can sometimes be a benefit and a curse. Too often the Inland Empire gets overlooked when fighting for federal resources. The SBA regularly holds seminars and lectures in Los Angeles and Sacramento, but it can be extremely difficult for a small business owner to take time away from their business and make a trip to a distant city or county. The Small Business Administration should consider holding mobile seminars or increasing the use of webinars to reach a broader range of business owners. Few of the businesses had worked with the SBA and an increased presence in the Inland Empire could help raise awareness of the resources available.

Federal Manufacturing Incentives

With its available land, access to air, rail and highway transport, research university, and proximity to the ports of Los Angeles and Long Beach, the Inland Empire is an ideal place for a dynamic, thriving manufacturing sector. Manufacturing spurs both direct and indirect job creation that can cross a range of related business sectors. The Obama Administration has announced several initiatives to help communities like the Inland Empire. Congressman Takano led a bipartisan letter signed by all eight House Members representing Riverside and San Bernardino Counties in supporting the declaration of the Inland Empire as a “manufacturing community” under the Department of Commerce’s new Investing in Manufacturing Communities Program. This designation would have given the Inland Empire priority when bidding for up to $1.3 billion dollars from more ten federal agencies. CarbonLITE, the bottle recycling plant in Riverside, and many others, would have been key participants in this new venture. Despite the impressive bipartisan support, the Inland Empire’s bid was ultimately unsuccessful. However, community leaders are working with Los Angeles to join in their IMCP designation and get the same priority in bidding for federal funding, a process Congressman Takano strongly supports.

Federal Research

Continued federal investment in basic scientific research and our nation’s research universities will also help to spur job creation and innovation. UC Riverside is an important resource to the Inland Empire as they make the breakthroughs in the laboratory that can one day lead to new products and opportunities in the marketplace and change lives. A commitment to research and development helps attract businesses, like IscaTech and Olfactor Laboratories to our region, but our researchers cannot continue to make the breakthroughs we need if they cannot rely on consistent federal funding. Sequester cuts and diminishing budgets have hampered new discoveries. A renewed federal commitment to all levels of the research pipeline, from basic research to product development, and partnerships that link researchers with businesses are wise investments that Inland Empire needs.

SUPPORT LOCAL INNOVATION

The Maker Movement

The Maker Movement is about increasing access to new technologies that lower the barriers to entrepreneurship and give independent inventors, manufacturers, and tinkerers the tools and space to innovate. Makerspaces are popping up around the country. These unique spaces allow the public to learn to use new technologies like desktop 3D printers, CNC machines, and consumer grade laser cutting machines.

The growing Maker Movement gives people an alternative way to get hands on experience with tools and techniques that would otherwise be out of reach. Collaborative workspaces and group classes help foster innovation, and are already being used to build custom dental fittings and crowns; custom prosthetics; and electrical circuits. Creations are coming out of maker spaces that help consumers and make it easier for small business owners to interact with customers. The Square™ credit card reader was first prototyped at TechSchop, a makerspace in Menlo Park. By connecting to a smartphone or tablet, this simple and easy device now offers business owners a secure and easy way to accept payments anywhere.

Often these makers are unsure how best to collaborate or coordinate with the federal government and regulatory agencies. That’s why Congressman Takano has co-founded the bipartisan Congressional Maker Caucus with Reps. Tim Ryan (D-OH), Steve Stivers (R-OH), and Mick Mulvaney (R-SC). Already, the Caucus has held several events on Capitol Hill to educate lawmakers about the entrepreneurial spirit of the Maker Movement. Congressman Takano attended the first White House Maker Faire with President Obama in June, and invited Vocademy, a makerspace in Riverside, to participate in the event.

Additionally, the Caucus will work to ensure federal government enacts policies that will help this innovative movement continue. One way to improve communications between makers and the federal government is to create an Office of the Maker Advocate within Department of Commerce or Small Business Administration. The advocate would assist with proactive outreach to makers and help makers navigate the resources that are available to commercialize their idea or product. Additional policies to support makers could include a pilot program for public-private partnerships between makerspaces and local workforce investment boards to improve entrepreneurial training programs under WIOA.

For more information, follow the Congressional Maker Caucus on Twitter, @MakerCaucus.

Coworking Spaces

In addition to the Maker Movement, coworking spaces provide individuals an environment conducive to innovation. Located in the heart of downtown Riverside, Riverside.io offers entrepreneurs without a store front a clean, well-lit place to work, brainstorm, and meet other creative business people. These types of spaces allow entrepreneurs to minimize startup costs and get the ball rolling on their creative ideas. Brew Crew, another coworking space in Riverside, allows small brewers share equipment and brew in a collaborative space. The federal government should consider how federal resources can help these new spaces flourish. Coworking spaces could provide an ideal location for the Small Business Administration to hold seminars and meet with entrepreneurs across the country. They also may offer the unemployed a space to launch a new venture. The federal government should consider a pilot grant program where it offers tax incentives to coworking spaces that provide discounted rates for the unemployed, particularly the long-term unemployed and unemployed veterans.

Crowdfunding

With access to capital tight in the wake of the economic downturn, businesses are looking for new ways to finance growth and investments in their business. Online resources like Kickstarter and Indiegogo are providing entrepreneurs alternative routes to get the capital needed to start their next business or project. The JOBS Act of 2012 authorized the Securities and Exchange Commission to adapt securities law to allow small businesses to raise equity through crowdfunding. Before the law, individuals donating money through crowdfunding websites could only receive rewards or prize, but with this change people will actually be able to acquire equity in a company through a crowdfunding website. The SEC released proposed rules at the end of last year, and the agency is reviewing comments and expected to release a final rule at the end of this year to fully implement this provision of the law. Congressman Takano will be watching the rulemaking process closely and joined a bipartisan letter to the SEC encouraging them to issue a final rule that provides the flexibility small businesses need to raise capital and grow.

Helping Get Businesses Online

In today’s modern economy, a strong online presence can help many small businesses compete and attract customers. The internet has replaced the yellow pages as the place consumers turn for information about local goods and services. In fact, 97 percent of consumers look online to find the services they need. And yet, according to the Small Business Administration (SBA), 47 percent of small businesses don’t have a website. The SBA has online resources to help businesses improve their online presence, including developing mobile accessible sites and improving customer interaction. Congressman Takano’s office is committed to partnering with federal partners and business advocates to coordinate and host seminars so Inland Empire businesses are taking advantage of the benefits an online presence can bring.

THE AFFORDABLE CARE ACT AND SMALL BUSINESSES

The passage of the Affordable Care Act was an historic moment that will help give tens of millions of Americans access to quality, affordable health care, prevent insurers from denying coverage for pre-existing conditions, and allow young adults to stay on their parents’ plans longer. Health care coverage helps give employees improved peace of mind and increases productivity by creating a healthier workforce. With an uninsured rate of twenty-four percent, constituents

in the Inland Empire have much to gain from this law. In the first six months that Covered California was open for business, nearly 70,000 people in Riverside County purchased coverage through the online marketplace and even more qualified for coverage under Medi-Cal. Additionally, the Affordable Care Act is helping to drive down insurance premiums. When open enrollment began last year, health care premiums for plans offered in the state marketplaces were nearly twenty percent below industry estimates. Costs for plans offered to small employers were on average eighteen percent lower than what employers could expect to pay before the Affordable Care Act. Despite the benefits of the law, many employers cited employee benefits as a major concern, but few were aware of the resources that the Affordable Care Act offers to small businesses to help them cover their employees.

Impact of the Affordable Care Act

One of the provisions in the Affordable Care Act will require employers with 50 or more full-time equivalent employees to offer affordable health coverage to their employees or pay penalties if their employees purchase coverage through the state marketplace. Nationally, 96 percent of small businesses have fewer than 50 employees and would not be impacted by this change. However, several of the small businesses the Congressman visited expressed concern about the impact this could have on their business. This provision of the law was set to take affect at the beginning of 2014. However, after listening to small business owners, President Obama delayed the requirement for businesses with fewer than 100 employees to 2015, and businesses with fewer than 50 employees to 2016. This will allow additional time for businesses to understand the law and adapt accordingly. Through his Small Business Advisory Group, Congressman Takano is committed to continuing an open dialogue with small business owners to address and adapt to problems that may arise as the law is implemented.

Tax Credits for Small Businesses

The Affordable Care Act authorized tax credits to help small businesses afford the cost of insurance for their employees. Beginning this year, California’s Small Business Health Options Program (SHOP) offered small businesses with fifty or fewer employees a centralized place to shop for insurance. Employers could either choose a single plan for their employees, or pick a benefit level and allow employees to choose plan that’s right for them.

Beginning in 2014, small businesses with fewer than twenty-five full-time equivalent employees may be able to qualify for tax credits up to fifty percent of the amount they contribute towards employee health benefits. Sixty percent of the businesses Congressman Takano visited had twenty-five or fewer employees and could benefit from this tax incentive. However, greater outreach is necessary to help all eligible business learn about the benefits available to them under the law.

While the majority of the businesses Congressman Takano visited could benefit from these tax credits and will not be required to provide health coverage for their employees, other business owners expressed concerns about their ability to afford coverage. In his 2014 Budget, President Obama proposed expanding eligibility for the Affordable Care Act small business tax credit to businesses with fewer than 50 full-time equivalent employees. If the tax credit is expanded, it could benefit eighty-seven percent of the business visited as a part of this tour.

HELP INLAND EMPIRE SMALL BUSINESSES COMPETE IN THE GLOBAL MARKET

In the United States, trade accounts for nearly one-third of all economic activity, and U.S. exports directly support 9.7 million jobs. However, in recent years the number of goods and services our nation imports has grown to exceed the goods and services we export. In 2013, the United States’ trade deficit reached more than $476 billion, meaning we imported close to half a trillion more than we exported.

Export Assistance

Lowering our trade deficit will help create more jobs at home and relieve some of the pressure for companies to outsource jobs. While visiting Acura Spa Systems, Congressman Takano heard specifically about the challenges for small businesses in the global market and need for federal resources and assistance. The United States Export-Import (Ex-Im) Bank plays a key role in helping all businesses, large and small, export their goods to foreign markets. The Ex-Im Bank provides export financing through direct loans, loan guarantees, working capital finance, and export credit insurance. In 2013, the Ex-Im Bank supported $37.4 billion in exports nationally. In fact, in the last year the Ex-Im Bank helped support IscaTech, another one of the businesses Congressman Takano visited. The Ex-Im Bank also offers resources to small businesses considering exporting, initiating exports, and in expanding the goods and services they export. Authorization for the Ex-Im Bank is set to expire on October 1, 2014, and it is essential that Congress reauthorize the bank to ensure that American exports remain strong and local businesses have the support they need to compete in the global marketplace. That’s why Congressman Takano is an original cosponsor of the Protecting American Jobs and Exports, which would reauthorize the Ex-Im Bank for seven years and raise the lending cap by $5 billion each year.

INVESTMENTS IN INFRASTRUCTURE

Investments in infrastructure have a multiplying affect. Federal dollars help draw down state, local, and private investment to see projects completed. According to Standard and Poor’s, $1.3 billion in infrastructure spending could create 29,000 new jobs and result in $2 billion in economic growth. If we invest in infrastructure, companies like Adkan Engineers, which was forced to downsize due to economic downturn, can once again hire employees to meet the growing demand for new projects. Improving our community’s infrastructure not only creates these direct jobs, it can help attract businesses and workers by improving commute times and the ability to ship and receive products.

Perris Valley Line

The Perris Valley Line almost didn’t get off the ground. After years of delay, time was running out to secure the final piece of federal funding to extend Metrolink commuter rail service from Riverside to Perris. Congressman Takano sent a letter to the Federal Transit Administration (FTA) Administrator Peter Rogoff, urging him to maintain the $75 million that was appropriated by Congress to extend the rail line. Funding was secured, and construction on the Perris Valley Line began in October 2013.

The Perris Valley Line is expected to draw 4,400 direct and indirect jobs to the Inland Empire, both during the construction of the line, and as new businesses develop near the rail stations. The University of California’s new payroll and human resources center, UCPath, is an example of an employer drawn to the benefits of being located near commuter rail. This facility is expected to create 500 “white collar” positions, and will standardize and streamline human resources processes for the entire University of California System. This new facility will be located near the Moreno Valley/March Field Rail Station, making it easy to reach for employees and visiting staff from other UC campuses.

Energy Efficiency

Energy costs can add up for a small business, but programs to improve energy efficiency can help create jobs in the short term and lower costs in the long-run. When asked about the challenges of operating a business in Riverside County, the high costs of utilities ranked as one of the most common concerns among business owners. In the past, the federal government offered tax deductions for businesses investing in energy efficient upgrades. Businesses could qualify for up to $1.80 per square foot for improvements in interior lighting, building envelope, or heating, cooling, ventilation, or hot water systems that reduce the building’s total energy and power cost by 50 percent or more. Unfortunately, this tax deduction expired at the end of 2013. Congressman Takano supports renewing this tax incentive, making it easier for businesses to upgrade their facilities and saving them money in the long-run.