Senior Housing Bubble Held Together by Glue and Tax Dollars

Executive Summary

Reverse mortgages are loans that allow seniors to take equity out of their homes to help pay for living expenses or other costs. As the equity in their home decreases, the amount of the loan increases. Unlike a traditional mortgage, seniors do not make monthly payments. The loan becomes due when the borrower dies, moves out of the house, or fails to maintain the property and pay homeowner’s insurance and property taxes. This type of loan is almost always insured by the Federal Housing Administration.

As financial pressures on seniors have increased, the numbers of reverse mortgages have grown, and so have the opportunities for unscrupulous lenders to take advantage of seniors. These loans are complex, expensive, and drain equity from the property, leaving seniors with very few options later in life.

- One out of every ten reverse mortgage is in default and could face foreclosure.

- Reverse mortgages are expensive. After ten years, interest and ongoing fees on a lump sum reverse mortgage can add up to more than $100,000, after twenty years interest can reach more than $300,000 on top of the original loan amount.

- As defaults and foreclosures have increased, FHA’s reverse mortgages lowered the value of the Mutual Mortgage Insurance Fund by $5.2 billion in Fiscal Year 2012. Forcing the Treasury Department to transfer $1.7 billion to the MMI Fund for the first time in the Fund’s history in the fall of 2013.

- The decline in pensions, the economic recession, cost-of-living adjustments that don’t keep pace with the rising cost of health care, and increasing life expectancy have encouraged seniors to seek alternative ways to supplement their retirement income. In 1983, 62 percent of private sector workers were covered by a defined benefit pension plan. By 2010, that number dropped to just 19 percent.

- In the 1990s, less than 10,000 reverse mortgages were issued a year. In 2009, the number of reverse mortgages peaked at 114,412 loans, in fiscal year 2013 the Federal Housing Administration (FHA) backed 61,296 loans.

- Misleading advertisements that feature trusted celebrity spokespeople, like former-Senator Fred Thompson, Henry Winkler, Robert Wagner, and Pat Boone, often falsely imply that reverse mortgages are a government benefit, not a loan, and that there is not a risk that seniors will lose their home.

- If a homeowner passes away without also having the reverse mortgage in their spouse’s name, the surviving spouse could lose the home. After her husband passed away, a local woman from San Bernardino received a letter from her a reverse mortgage lender, informing her that unless she paid $293,000, she would lose her home.

- It’s time for the federal government to reconsider its involvement with reverse mortgages and make crucial changes to the program to protect seniors and taxpayers.

I. Background

What is a reverse Mortgage?

Reverse mortgages are loans that allow seniors to take equity out of their homes to help pay for living expenses or other costs. As the equity in their home decreases, the amount of the loan increases. Unlike a traditional mortgage, seniors do not make monthly payments. The loan becomes due when the borrower dies, moves out of the house, or fails to maintain the property and pay homeowner’s insurance and property taxes. If borrowers are not able to meet these requirements the loan becomes delinquent and the home can eventually go into foreclosure.

Nearly all reverse mortgages are insured by the Federal Housing Administration (FHA) through its Home Equity Conversion Mortgage (HECM) program. FHA insurance guarantees that borrowers will be able to access their authorized loan funds in the future even if the loan balance exceeds the value of the home or if the lender experiences financial difficulty. Lenders are guaranteed that they will be repaid in full when the home is sold, regardless of the loan balance or home value at repayment. Borrowers or their estates are not liable for loan balances that exceed the value of the home at repayment. The amount a senior can borrow is based on their age, the current interest rate, the appraised value of the home, the amount the senior owes on the home, the amount of fees charged and the federal loan limit, which is currently $625,000.

[i]

Who is eligible?

- Borrower Requirements:

- 62 years of age or older

- Own the property outright, or almost entirely

- Occupy the property as a principal residence

- Not be delinquent on federal debt

- Have financial resources to continue to make timely payment of ongoing property taxes, insurance and Homeowner Association fees, etc.

- Participate in a housing counseling session (typically by phone)

- Property Requirements:

- Meet all FHA property standards and flood requirements

- Single family home, or 2-4 unit home with one unit occupied by owner

- HUD approved condominium project

- Manufactured home that meets FHA requirements

- Financial Requirements

- Income, assets, monthly living expenses, and credit history will be verified

- Timely payment of real estate taxes, hazard and flood insurance premiums will be verified[i]

Payment Options

Seniors can select between several different payment options. They can choose an equal monthly payment over a fixed period of time or as long as the borrower lives and continues to occupy the home. Seniors can also use a reverse mortgage to take out a line of credit to receive unscheduled payments or installments at the times and in the amount of their choosing, or a combination of the two.

Another option allows seniors to receive all of their funds in one lump sum payment. In recent years, lump sum payments had grown to account for 70% of HECMs.

[iii] These types of reverse mortgages were most likely to become delinquent on taxes and insurance payments resulting in foreclosure, because borrowers are not always able to properly plan how to spend the money, and once it runs out they are left with little to no equity in their home and no other options for income. Since 2008, the vast majority of borrowers have started to take out 80 percent or more of the maximum they’re eligible for in a lump sum. HECM loans with such high up-front draws are twice as likely to have a tax-and-insurance default as are loans with initial draws of 60 percent, and four times as high as those with initial draws of 40 percent of the maximum allowed.

[iv] In December 2012, the FHA placed a moratorium on fixed-rate lump sum reverse mortgages under the HECM Standard program due to the high foreclosure rates.

[v] The following year, the FHA announced additional restrictions, requiring borrowers to pay a higher mortgage insurance premium if they take out more 60% of their principal loan limit at the time of closing.

[vi]

The Role of the Federal Government

Reverse mortgages were developed as a way for seniors who are “cash poor” to tap the equity in their homes to help pay for living expenses. Historically, these loans were viewed as a last resort and only taken out by older Americans who had depleted all other retirement resources.

[vii] The FHA insures reverse mortgages both to protect lenders and borrowers. Borrowers are guaranteed their payments even if the lender undergoes financial difficulty

. Lenders are repaid for their losses if the loan winds up exceeding the value of the house.

Why Seniors Take Out Reverse Mortgages

As economic pressures have increased, more seniors began to turn to reverse mortgages at an earlier age. By 2011, more than half of the borrowers taking out reverse mortgages were under age 70. The earlier a borrower takes out a reverse mortgage, the greater the risk they will deplete their home equity and run out of financial options as they age.

[viii]

The decline in pensions, the economic recession, cost-of-living adjustments that don’t keep pace with the rising cost of health care, and increasing life expectancy have encouraged seniors to seek alternative ways to supplement their retirement income. In 2002, Social Security wage replacement rate was 41 percent for the average retiree at age 65. By 2015, it’s expected to drop to 38 percent, and by 2030 to just 36 percent, 33 percent when adjusted for Medicare Part B premiums.

[ix] In 1983, 62 percent of private sector workers were covered by a defined benefit pension plan. By 2010, that number dropped to just 19 percent.

[x] All of these economic pressures have encouraged seniors to take out reverse mortgages. In the 1990s there were less than 10,000 reverse mortgages a year. In 2009, the number of reverse mortgages peaked at 114,412 loans, and in fiscal year 2013 the Federal Housing Administration (FHA) backed 61,296 loans.

[xi]

II. Key Findings

Reverse Mortgages Are Bad for Seniors

Reverse Mortgages are Expensive

Reverse mortgages are extremely expensive and should only be used as a loan of last resort. Borrowers must pay both upfront and ongoing fees. The ongoing costs are often financed into the loan and seniors may be unaware of just how quickly the fees add up. In many cases, alternatives such as Home Equity Lines of Credit, or other state and local programs may offer seniors a better option.

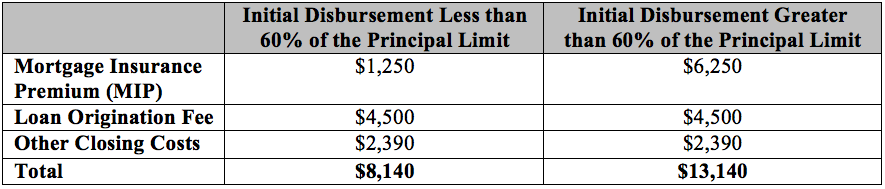

- Upfront Costs

- Initial mortgage insurance premium (MIP): Under the HECM Program the initial MIP is either 0.5% or 2.5% of the appraised value of the home, depending on the disbursement option the senior chooses. Borrowers receiving more than 60% of the principal limit in the first year are charged a 2.5% MIP. Borrowers receiving less than 60% of the principal limit in the first year are charged 0.5% MIP.

- Origination Fee: Lenders can charge up to $2,500 for homes valued at less than $125,000, and 2% of the first $200,000 of a home's value plus 1% of the amount over $200,000. HECM origination fees are capped at $6,000. These costs are typically financed into the loan, reducing the amount available to the borrower.

- Closing costs: Costs from third parties can include an appraisal, title search and insurance, surveys, inspections, recording fees, mortgage taxes, credit checks and other fees. Typically financed into the loan, reducing the amount available. Closing costs can total between $1,500 and $2,500.

- Counseling fee: Historically, these costs were covered by the Department for Housing and Urban Development (HUD), but as federal funding was cut, some counseling agencies began to charge borrowers. While some non-profits still provide free counseling, others counselors in California charge between $125 and $225 for their services.

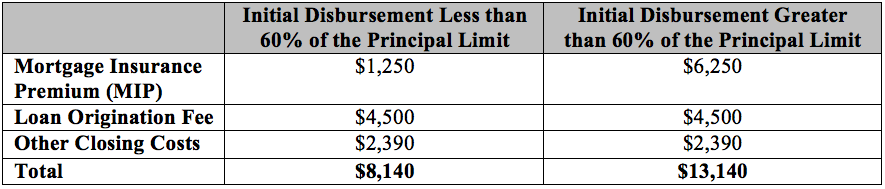

According to the FHA’s Reverse Mortgage Calculator, up-front costs can vary widely. For a 68-year-old taking out a reverse mortgage in Riverside, California, the fees can range between $8,140 and $13,140 depending on the amount the seniors chooses to receive at closing or during the first twelve months. This example assumes the value of the home is $250,000, with $20,000 left to be paid on the original mortgage, and shows estimated closing costs depending on the disbursement option.

- Ongoing Costs

- Monthly mortgage insurance premium (MIP): The FHA assesses an ongoing MIP equal to 1.25% of the loan balance. It is added to the loan amount each month, increasing the amount the borrower owes if the loan becomes due.

- Servicing Fee: Lenders may charge a monthly servicing fee of no more than $30 if the loan has an annually adjusting interest rate and $35 if the interest rate adjusts monthly. The initial servicing fee is deducted from the funds available to the borrower, and monthly servicing fees are added to the loan balance. Over ten years, servicing fees can add up to $3,600, and as much as $7,200 over twenty years.

- Interest: Each month, interest accrues on the loan. The average interest rate on reverse mortgages in the 41st Congressional District is 3.31%. Quotes from reverse mortgage lenders have ranged as high as 4.99%.

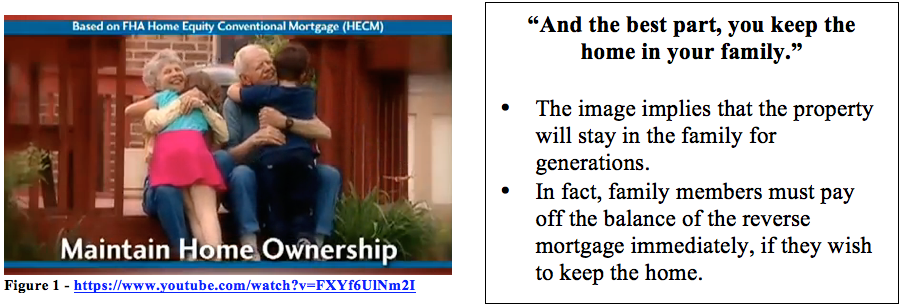

Take the same example of a 68-year-old taking out a reverse mortgage on a house worth $250,000 in Riverside. Assume the borrower is approved for a lump-sum of $135,000 and 4.99% in interest. After ten years, the loan balance will grow to more than $250,000. After twenty years, the loan balance will be more than $450,000. Should the borrower die without having their spouse on the reverse mortgage, the spouse will have to pay off the loan to stay in his or her home. Likewise, should the borrower decide their circumstances have changed and they’d like to move, but keep the home in the family, the family will have to pay the lesser of the loan balance or 95% of the appraised value of the home to retain the property.

Reverse Mortgages Strip Equity from Homes and Leave Seniors without Options

Reverse mortgages strip equity from seniors’ homes. When it comes time to finally move and sell the house, they may no longer have any equity in the home because the loan balances have grown so quickly. They can’t sell the home and use the equity to pay for their next move. Nor are they left with equity in the home for their family to inherit.

Take the story of a borrower from Florida: “I feel tricked that I was not advised that if I became disabled this could become a noose, that I could not live my dream anywhere else with this reverse mortgage. I saw commercials that say you have your home for as long as you want it. It is your home. I don’t want to trash the program but I want to highlight the problems. Closing fees are so expensive. I ended up paying $11,000 for $57,000. Before the reverse mortgage, my monthly mortgage was $254. Now I pay $235 per month in mortgage insurance and I can’t rent out my home. I cannot stay in my home without the care I need, but if I leave I will lose the home.”

[xii]

How Lenders Exploit Seniors

Celebrity Spokespeople

Reverse mortgage lenders use trusted celebrity spokespeople to encourage seniors to take out these types of loans. Take these examples from actors and even a former U.S. Senator.

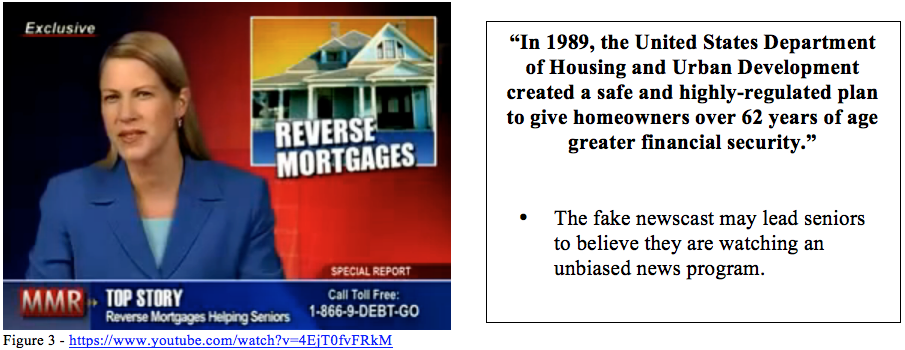

- Fred Thompson for American Advisors Group (AAG):“A government insured reverse mortgage allows seniors to stay in their own home and to turn their equity into tax-free cash.”

- What Sen. Thompson fails to mention is that reverse mortgages could impact eligibility for Medicaid or Supplemental Security Income (SSI).

- The ad includes disclaimers in small, almost illegible font that only the keenest eyes can spot. He doesn’t mention that homeowners must continue to pay insurance, taxes, maintain the property, and comply with loan terms.

- Testimonials from customers in the same ad claim, “It doesn’t cost anything. You won’t lose anything, and at the end of the day you might be pleasantly surprised.” These downplay the risks that seniors face when taking out reverse mortgages.[xiii]

- Henry Winkler for One Reverse Mortgage: “It will eliminate your monthly mortgage payments and give you tax-free cash from the equity in your home. And here’s the best part, you still own your home.”

- A customer testimonial says, “We’re traveling more. We’re eating out more.” These kinds of comments insinuate that reverse mortgages are viable sources for expendable income. In fact, reverse mortgages are extremely costly and should only be used as a last resort.

- Winkler, “The cash does not affect your social security.” Half-truth: reverse mortgage income can affect eligibility for Supplemental Security Income (SSI) for some of our poorest seniors. [xiv]

- Robert Wagner and Pat Boone are also Paid Spokespeople

“Today is the day. The day to breathe a little easier. The day to truly enjoy life again. Hi, I’m Robert Wagner. Over the years, so many folks I’ve met have told me that they’d love a chance to spend time with their grandkids, or … just find a quiet piece of stream and fish the day away, only their finances just wouldn’t give them that chance. A reverse mortgage can change all that.”

“Hello, friend. I’m Pat Boone and I’m here to tell you about the popular government insured program that’s designed for your generation.”

Misleading Marketing

A 2009 Government Accountability Office (GAO) Report found that many lenders used incomplete or inaccurate sales tactics to encourage seniors to take out reverse mortgages. The GAO cited advertisements that include misleading or false statements, including:

- The borrower cannot owe more than the value of the home

- The lender cannot foreclose on an HECM and the borrower cannot lose the home

- The borrower cannot outlive a reverse mortgage

- Implications that a reverse mortgage is not a loan, but instead a government benefit or entitlement

- Geographic or time limits for reverse mortgages that encourage seniors to act quickly before taking the time to properly weigh their options

- The use of government language or symbols to imply government affiliation[xv]

Illinois Attorney General Lisa Madigan filed lawsuits for misleading advertisements against Hartland Mortgage Centers and American Advisors Group, the company that employs Fred Thompson as a spokesperson.

[xvi] In Massachusetts, the Commissioner of Banks issued cease-and-desist orders to a handful of reverse mortgage firms for operating without a licenses and falsely promising seniors that they wouldn’t lose their homes.

[xvii]

In November 2012, the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) sent warning letters to a dozen mortgage lenders and brokers advising that they may be violating federal law with misleading advertisements. Six lenders were also placed under formal investigation for more serious violations. The CFPB found that many of these lenders were often targeting seniors and employing the same misleading tactics highlighted by the earlier GAO report.

[xviii]

Examples of Misleading Advertisements

Reverse mortgages are complex products and difficult for seniors to understand

The Department of Housing and Urban Development (HUD) requires borrowers to complete counseling before taking out a reverse mortgage, however the complexity of the transaction still leaves many seniors confused. The majority of counseling sessions occur over the phone and it can be difficult for seniors and those who are hearing impaired to adequately process the information. Counselors are expected to cover fifty-one different topics, and yet most sessions only take about an hour.

Funding for housing counseling has been cut and counselors are under pressure to streamline counseling. In some cases, counselors don’t get paid until the reverse mortgage is closed. This conflict of interest may pressure counselors to encourage seniors to finalize the reverse mortgage. Seniors don’t realize the risks they face if the reverse mortgage is taken out in only one spouse’s name. This happened to a local woman from San Bernardino, who, after her husband passed away, received a letter from her a reverse mortgage lender, informing her that unless she paid $293,000, she would lose her home.

[xix]

Reverse Mortgages are Bad for the Federal Government and Taxpayers

Reverse Mortgages and the Housing Crisis

As housing prices dropped during the recession, it became increasingly challenging to predict whether homeowners could keep up with taxes and insurance obligations. One out of every ten reverse mortgages is in default or foreclosure.

[xx] With reverse mortgage defaults and foreclosures on the rise, many major banks, including Wells Fargo and Bank of America, stopped issuing reverse mortgages.

As housing values dropped, it became more likely that loan balances would exceed the property value, and that lenders could not recoup the value of the loan when the house was sold. Because reverse mortgages are backed by the FHA, the federal government had to pay lenders for these losses. As defaults and foreclosures increased, so did the amount the FHA had to pay out to lenders. As a result, the HECM program lowered the value of FHA’s Mutual Mortgage Insurance Fund by more than $5.2 billion in Fiscal Year 2012.

[xxi] The reverse mortgage program accounted for only 7% of the agency’s total loan guarantees but was responsible for 17% of its projected losses.

[xxii] Last fall, the FHA needed a payment of $1.7 billion from the Treasury to ensure that it could continue to meet all of its capital reserve requirements. The first time in its history the agency has had to request additional funding so the MMI could continue to meet its obligations.

[xxiii]

Recent Federal Action

Congress and the Obama Administration have taken note of the negative impacts that reverse mortgages are having on seniors and the FHA. In 2009, as Congress debated financial reform, Rep. Jan Schakowsky (D-IL) included an amendment in the Dodd-Frank Wall Street Reform and Consumer Protection Act to give the newly created Consumer Financial Protection Bureau (CFPB) the authority to monitor and regulate reverse mortgage lenders. This has allowed the CFPB to take a close look at the predatory nature of reverse mortgage lenders and to release a comprehensive report on the issue. According to Richard Cordray, Director of the CFPB, “Consumers tell us stories about being deceived and misled. Just recently, we saw a mailer that portrayed a reverse mortgage as a government benefit rather than a financial product. The mailer came with what appeared to be a government seal and claimed that a phony piece of legislation would help seniors save their homes.”

[xxiv] The CFPB continues to receive complaints through its website and hotline and is working with local, state, and federal partners to root out these kinds of scams.

More recently, Carol Galante, the Assistant Secretary for Housing & Federal Housing Administration Commissioner, testified before the Senate Appropriations Committee about the impact that reverse mortgages have had on the Mutual Mortgage Insurance Fund. “Originally designed to be used like an annuity, in recent years market circumstances and lender preferences have shifted greater numbers of borrowers to take full draws via the Fixed Rate Standard product,” Ms. Galante said. “Thus, borrowers are taking all of the funds available to them up-front and often do not have the resources necessary in later years to pay property taxes and insurance, thereby triggering a default on the loan. Due to these changes in usage and performance, the budget estimates that the use of the HECM program results in a negative value of $5.248 billion and a disproportionately negative impact to the Fund.”

[xxv] The status of the HECM portfolio improved in 2013, but it took a transfer of $1.7 billion from the Treasury and $4 billion from the forward mortgage portfolio to help stabilize the account.

[xxvi]

As a result, Congress took action to give the Federal Housing Administration (FHA) more flexibility when managing the HECM reverse mortgage program. Congress passed and the President signed into law the Reverse Mortgage Stabilization Act, on August 9, 2013. This new law gave the FHA the authority to make changes to improve the fiscal stability of the HECM program. These changes included, requiring borrowers to undergo a financial assessments before they take out a reverse mortgage, setting up escrow accounts to ensure borrowers have enough funds to continue to pay insurance and taxes, and limiting the amount borrowers can take in an upfront lump sum payment.

[xxvii]

Reverse Mortgages are Bad for the Inland Empire

The story of a local woman highlights the dangers of reverse mortgages. She, like many seniors, didn’t realize that her name also needed to be on the reverse mortgage taken out by her husband on their San Bernardino home. After her husband passed away she received a letter from her a reverse mortgage lender, informing her that unless she paid $293,000, she would lose her home.

[xxviii] There are currently 2,268 active HECM reverse mortgage loans in the 41st Congressional District. During Fiscal Year 2012, the last year for which full data is available, the default rate in the 41st Congressional District was nearly three points higher than the state average.

According to the FHA, some pockets of the district have even higher default rates. In Downtown Riverside and the Orangecrest neighborhood near March Air Reserve Base, the default rate is 14%. These numbers exceed the national rate of FHA mortgages that are facing default or foreclosure. Nationally, only 8.27% of FHA backed single-family mortgages are in default or foreclosure.

[xxix]

More than half of the new reverse mortgages taken out during Fiscal Year 2012 in the 41st Congressional District were lump sum payments. On average, these lump sum borrowers were younger than their peers choosing more gradual payment options. The average age for a borrower choosing a lump sum payment option was 71, while the average age for the other options ranges from 73-80. These trends hold on both the state and county level. This means that the youngest borrowers were choosing the riskier lump sum payment and expecting it to last over a longer period of time until they pass away or move out of the house.

III. Solutions

Improve Counseling and Consumer Protections

Improving counseling sessions and strengthening consumer protections will help to defend seniors from unscrupulous lenders. Cuts to funding for housing counseling have stretched counselors thin. Federal funding should be reinstated to insure that counselors can remain unbiased and provide the best possible information. Counseling fees should be paid for by the company servicing the loan. If no loan is taken the federal government should cover the costs.

Seniors should have the time to properly review their decision to take out a reverse mortgage. When seniors purchase an annuity they usually have ten days to review the decision and cancel without a penalty. In California, this “free look” period lasts for thirty days. For reverse mortgages, seniors only have three days to review their decision and cancel without penalty.

[xxx] Extending the “free look” period to ten or thirty days would allow borrowers to properly review and reverse their decision if needed.

Require Brokers and Originators to Act in the Best Interest of Seniors

Reverse mortgage lenders and servicers should have a legal fiduciary duty to act only in the best interest of borrowers. This should include considering if taking out a reverse mortgage puts the borrower at risk of losing their home, as well as, whether other financial products might better meet the needs of the borrower and their family.

Introduce Protections to Limit Defaults and Hold Lenders Accountable

It can be difficult for seniors to accurately plan for the property maintenance and taxes that they will be required to continue paying under the terms of their reverse mortgage loan agreement. While the FHA has taken recent steps to limit defaults, companies with high default rates should continue to face particular scrutiny. The FHA should consider offering different levels of insurance to lenders based on their volume of defaults. Lenders with low defaults should continue to receive the full backing of the loans, but those with persistently high default rates could see their federal backing diminish, and only be insured for a portion of the value of the loan. This will give lenders a real incentive not to lend to seniors who won’t be able to fulfill the terms of the loan.

Strengthen Protections for Spouses and Family Members

Many seniors don’t fully understand the impact a reverse mortgage can have on their family.

A thorough discussion of the impacts a reverse mortgage could have on spouses or family members should be a mandated topic during the counseling session. Additionally, lenders should be required to send written notification to non-borrowing spouses and other family members, so there is a record of the repercussions should the borrower pass away. CFPB and FTC have been taking steps to improve housing counseling, but stricter enforcement and sharing of best practices must be increased. Congressman Mark Takano will be sending a letter to both the CFPB and FTC urging them to maintain strict enforcement and oversight of housing counseling sessions.

[ix] “Social Security Replacement Rates for Average Earner Retiring at Age 65, 2002, 2015, and 2030,”

The Boston College Center for Retirement Research, March 2013.

[xii] “Comments to the Consumer Financial Protection Bureau On Request for Information Regarding Consumer Use of Reverse Mortgages,”

Consumers Union of the U.S, Inc., California Advocates for Nursing Home Reform, July 2, 2012,

http://consumersunion.org/pdf/Comments_CFPB_8-31-12.pdf.

[xv] “Reverse Mortgages: Product Complexity and Consumer Protection Issues Underscore Need for Improved Controls over Counseling for Borrowers,”

The Government Accountability Office, June 2009,

http://www.gao.gov/new.items/d09606.pdf.

[xx] Erica Jacquez, Congressional Affairs,

U.S. Department of Housing and Urban Development, email to author, August 5, 2013.

[xxiii] Chad Chirico and Susanne Mehlman, “How FHA’s Mutual Mortgage Insurance Fund Accounts for the Cost of Mortgage Guarantees,”

The Congressional Budget Office, October 22, 2013,

http://www.cbo.gov/publication/44634.

[xxiv] Erica Jacquez, Congressional Affairs,

U.S. Department of Housing and Urban Development, email to author, August 5, 2013.

[xxvii] “Mortgagee Letter 2013-27: Changes to the Home Equity Conversion Mortgage Program Requirements,”

U.S. Department of Housing and Urban Development, September 3, 2013.

[xxix] “FHA Single Family Loan Performance Trends,”

U.S. Department of Housing and Urban Development, May 2013.